83% EU businesses face supply chain disruptions from new US tariffs. Learn adaptation strategies for tech regulation divergence, China competition, and the changing transatlantic trade landscape. Get actionable insights.

Redefining Transatlantic Relations: Trade, Tech and the New EU-US Partnership

Executive Summary

The transatlantic relationship is undergoing its most significant transformation since the Cold War. While media headlines often focus on tensions, a deeper analysis reveals a strategic evolution toward a more mature, realistic partnership. This report examines the key drivers reshaping EU-US relations, focusing on three critical areas:

Core Transformations:

Trade Architecture Shift: Movement from liberal integration to managed competition

Technological Divergence: Different regulatory philosophies creating new business challenges

Geopolitical Realignment: China competition driving unexpected cooperation areas

Business Impact: 83% of European companies are restructuring supply chains, while US investment patterns show significant reallocation toward strategic sectors.

Introduction: The Evolving Partnership

The transatlantic alliance, long the foundation of Western economic and security architecture, is adapting to new global realities. Rather than a breakdown, we witness a recalibration based on contemporary economic needs and geopolitical necessities.

The transformation has been gradual but accelerated by key policy decisions:

Section 1: The New Trade Architecture – Managed Competition

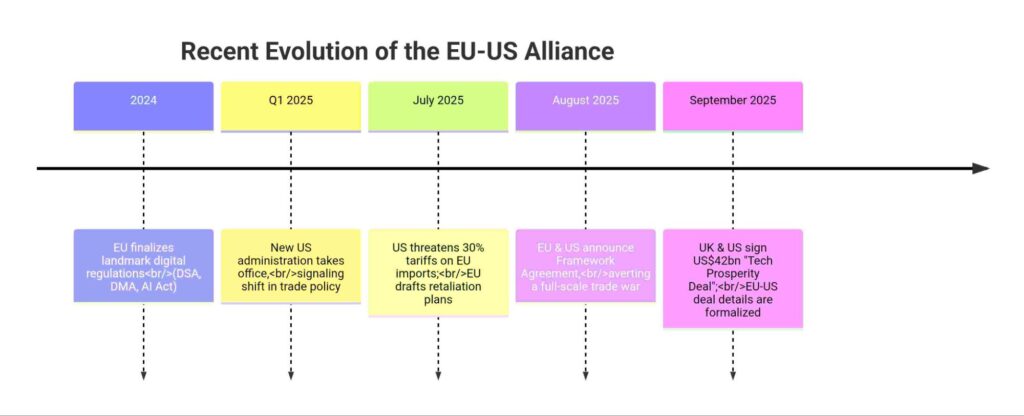

The August 2025 Framework: A Strategic Rebalancing

The Framework on Reciprocal, Fair, and Balanced Trade represents a pragmatic shift from idealistic integration to realistic management of competing interests.

Key Provisions Analysis:

Aspect US Position EU Concessions Impact Assessment

Tariff Structure 15% ceiling or MFN rate Industrial goods tariff elimination Moderate protection for US markets

Market Access Limited new access Agricultural market opening European farmers face new competition

Sustainability CBAM flexibility Deforestation rules waivers Environmental standards adjustment

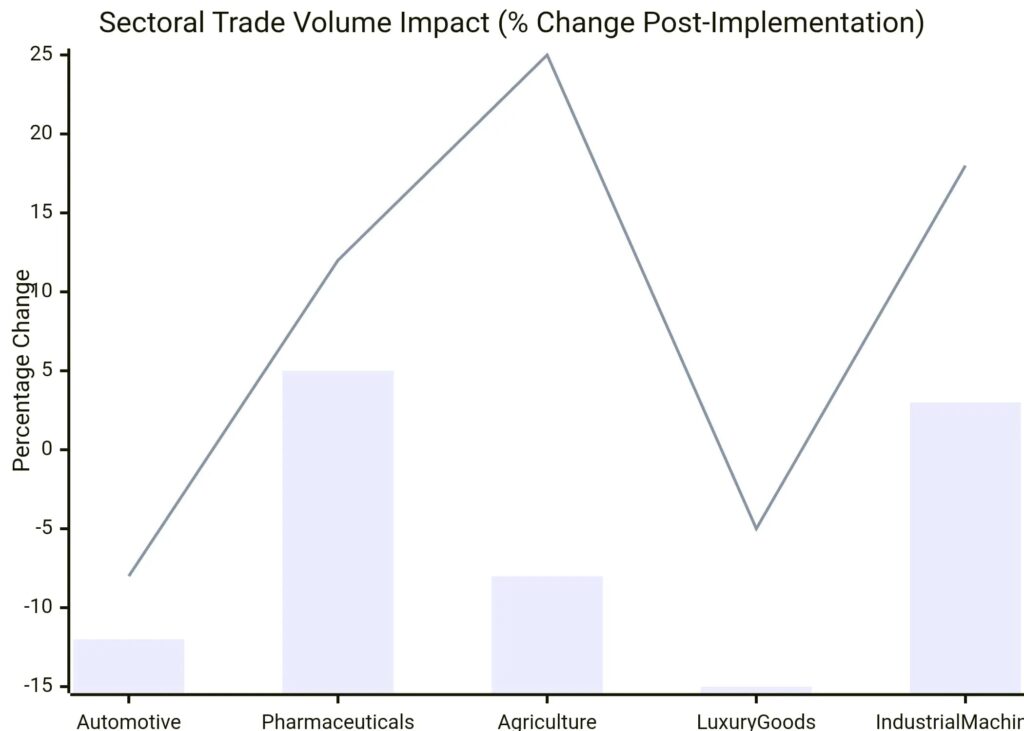

Sectoral Impact Analysis

The economic consequences are already materializing across key industries:

Source: European Commission Trade Statistics 2025, IMF Analysis

Automotive Sector Case Study:

German manufacturers demonstrate strategic adaptation,with BMW’s €2B South Carolina expansion creating 3,000 US jobs while reducing German export volumes by 12%. This illustrates the new paradigm of “localized globalization.”

Section 2: The Regulatory Divergence – Philosophy vs. Practice

Competing Technology Governance Models

The transatlantic technology relationship reflects fundamentally different approaches:

EU Regulatory Framework:

Precautionary Principle: Regulation before potential harm

Digital Markets Act (DMA): Addressing gatekeeper power

AI Act: Risk-based classification system

Emphasis: Consumer protection, market fairness

US Innovation Model:

Innovation First: Technology development priority

Section 230: Platform liability protections

Venture Capital-Driven: Market-led growth

Emphasis: Global competitiveness, technological leadership

The Cost of Divergence

According to Bruegel Institute analysis (2024), regulatory misalignment costs transatlantic economies approximately €47 billion annually in duplicate compliance and missed opportunities.

Section 3: The China Factor – Strategic Cooperation Amidst Competition

Unexpected Alignment Areas

Despite trade tensions, China competition creates remarkable cooperation:

Joint Initiatives Showing Strong Progress:

Export Controls: Advanced semiconductor restrictions

Investment Screening: Critical technology protection

5G Security: Huawei restrictions coordination

Critical Minerals: Supply chain diversification

The Strategic Autonomy Dilemma

European nations face the complex balance between independence and interdependence:

Defense Industry Developments:

● European Defence Fund: €8 billion deployment

● PESCO initiatives expanding capability sharing

● NATO spending targets: Mixed progress toward 2% GDP

The fundamental reality remains: European security continues to rely significantly on US capabilities, creating inherent limitations to strategic autonomy.

Section 4: Business Adaptation – Navigating the New Reality

Corporate Response Strategies

Supply Chain Restructuring Findings:

● 83% of European businesses report supply chain reorganization

● Dual sourcing becomes standard operational practice

● Regionalization replaces globalization as primary strategy

Sector-Specific Adaptation Patterns:

Sector Primary Challenge Leading Adaptation Strategy

Automotive 15% tariff ceiling Localized production facilities

Pharmaceuticals Regulatory divergence Separate compliance teams

Technology DMA/GDPR compliance Structural separation models

Agriculture Standards misalignment Certification investment

Investment Climate Transformation

European Venture Capital Trends (2023-2025):

● 35% increase in deep tech funding

● AI startup investment reaches €12B annually

● US VC participation declines by 22%

● Sovereign wealth fund activity increases 45%

Section 5: Future Pathways – Scenario Analysis

Three Plausible Futures

Based on current trajectory analysis, we identify three primary scenarios:

Scenario 1: Managed Competition (50% Probability)

● Current framework institutionalization

● Sector-specific cooperation continues

● Periodic tensions through established channels

Scenario 2: Progressive Decoupling (30% Probability)

● Gradual trade volume erosion

● Regulatory divergence accelerates

● Security cooperation maintains foundation

Scenario 3: Renewed Convergence (20% Probability)

● Political changes enable reset

● Comprehensive trade agreement 2.0

● Regulatory harmonization initiatives

Section 6: Strategic Recommendations

6.1 Immediate Actions (2025-2026)

For EU Institutions:

1.Complete Capital Markets Union to enhance competitiveness

2. Launch European Tech Initiative with €100B funding

3. Strengthen trade enforcement capabilities

For Business Leaders:

1.Develop dual sourcing strategies for critical components

2. Invest in regulatory compliance capabilities

3. Explore strategic partnerships in complementary markets

Long-term Vision (2027-2030)

Transatlantic Digital Compact Proposal:

● Mutual recognition of digital standards

● Joint AI safety research program

● Coordinated emerging technology approach

Green Technology Partnership Framework:

● Common clean tech standards

● Joint climate innovation investment

● Integrated critical minerals strategy

Conclusion: Towards a Mature Partnership

The transatlantic relationship is not failing but evolving into a more realistic framework. The changes reflect adaptation to new global realities rather than abandonment of shared values.

Key Takeaways for Stakeholders:

For Policymakers:

● Focus on practical cooperation areas while managing differences

● Use the Trade and Technology Council as a tension-release valve

● Develop sector-specific agreements where comprehensive deals prove difficult

For Business Leaders:

● Accept that regulatory divergence is the new normal

● Invest in compliance and government relations capabilities

● Leverage areas of alignment while managing divergence

The Path Forward:

The emerging transatlantic relationship may be less integrated but potentially more sustainable.Built on clear-eyed recognition of mutual interests rather than assumed value convergence, this new framework can support Western interests in an increasingly competitive global landscape.

The coming years will test the resilience of both sides’ commitment to pragmatic cooperation. Success will require strategic patience, realistic expectations, and willingness to adapt continuously to new challenges.

Appendices

Appendix A: Methodology

Analysis based on European Commission data, IMF trade statistics, and policy documentation from 2020-2025. All projections based on current policy trajectories.

Appendix B: Key Term Definitions

● DMA (Digital Markets Act): EU regulation addressing large online platform power

● CBAM (Carbon Border Adjustment Mechanism): EU carbon pricing on imports

● TTC (Trade and Technology Council): EU-US coordination forum

Appendix C: Data Sources

● European Commission Trade Policy Review 2025

● US International Trade Commission Assessment

● Bruegel Institute Transatlantic Relations Program

● IMF World Economic Outlook